Auckland’s Premier Automation Agency for Predictable, Scalable Growth

Leadica for Financial Services

Tired of chasing leads that never convert? Leadica does the heavy lifting, so you can focus on writing policies, closing loans, and settling mortgages.

Discover the growth system built for ambitious financial services teams.

4.8

500+ reviews

Imagine your calendar packed with qualified borrowers and buyers – without the cold calling grind. Here’s how Leadica changes the game:

Stop wasting time on tyre-kickers. Get booked meetings with clients ready to take out a loan, sign an insurance policy, or secure a mortgage.

Our team runs the outreach, follow-up, and nurturing so you meet with prospects who already know why they’re speaking with you

No missed calls. No ignored web forms. Our AI Voice and SMS agents respond instantly, qualifying and booking prospects into your calendar 24/7.

Your old database is gold. We revive past applicants, declined quotes, and cold enquiries through SMS, email, and AI Voice drops – turning lost opportunities into new business.

Whether you’re focused on consumer loans, insurance, or mortgages, Leadica is built for financial services providers who want a predictable flow of qualified appointments – without extra admin.

Fill your diary with borrowers who meet your lending criteria and are ready to move forward.

Book meetings with individuals and businesses looking to secure cover – from life to health to general insurance.

Stay top-of-mind with serious buyers. Book consultations with clients actively looking to secure or refinance.

Punch above your weight. Get the same lead system used by national brands – tailored to your patch and products.

Here’s how you go from inconsistent enquiries to a steady flow of qualified clients – without cold calling or chasing.

We target borrowers, policy seekers, or home buyers based on your criteria, credit signals, and location.

We orchestrate outreach across LinkedIn, email, SMS, phone, and retargeting ads – with proven messaging that sparks real conversations.

Every after-hours or weekend enquiry gets answered on the spot – qualified and booked before competitors even call back.

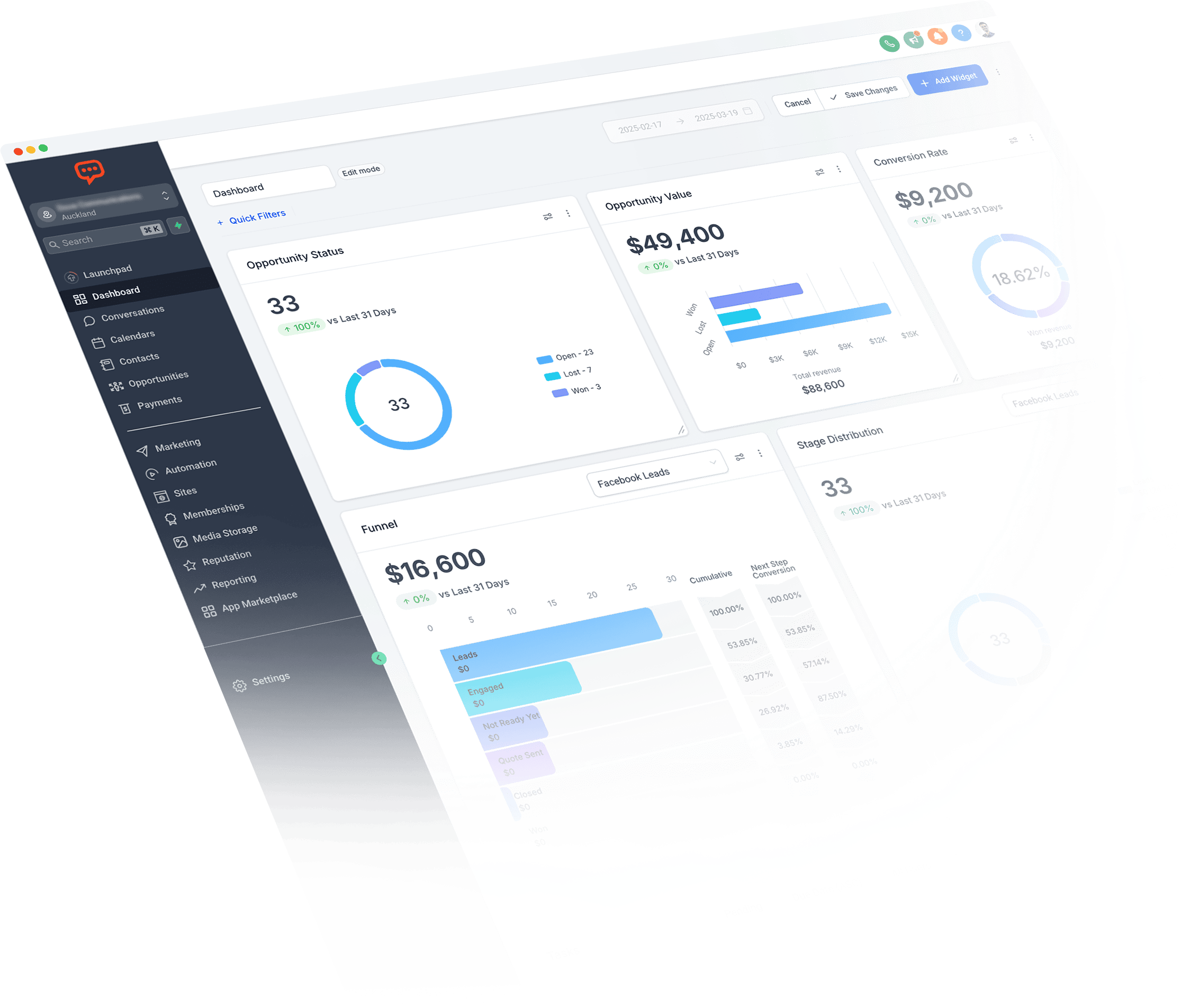

No double-handling. Bookings and lead data sync into your CRM (Salesforce, Pipedrive, Mortgage Brain, and more).

We continuously refine targeting, messaging, and show rates so your calendar keeps filling – month after month.

Imagine every after-hours enquiry answered instantly – with no missed calls, texts, or web forms. Leadica’s AI agents respond in real time, qualifying and booking appointments on your behalf.

Available as a flexible add-on for financial services teams that want true 24/7 coverage – so no hot lead slips away.

Stop relying on referrals or cold leads. Whether you want to revive past clients, capture every inbound enquiry, or boost your consultation bookings – Leadica delivers a steady stream of qualified meetings week in, week out.

Let’s map out your pipeline and show you exactly how the system works for your firm. No obligation – just clarity.

Most financial services teams see qualified appointments within 2–4 weeks of launching Leadica’s system. This is because we combine outbound campaigns with inbound AI follow-up, which accelerates momentum. If you already have a past enquiries database, results can be even faster – often within the first week – as we reactivate dormant leads with AI SMS and Voice.

Yes. Leadica’s appointment system is designed for personal loan companies, insurance agencies, and mortgage brokers. Campaigns are tailored to your compliance needs, product types, and target audience. That means whether you want more borrowers, policy seekers, or home buyers, we build a predictable pipeline of qualified appointments for your sector.

Most lead providers sell raw “leads” – spreadsheets of names you still have to chase. Leadica delivers booked appointments, not just contacts. We combine omnichannel campaigns, AI Voice, and AI SMS follow-up to ensure every enquiry is qualified, nurtured, and scheduled. You meet with prospects ready to talk about loans, insurance, or mortgages – not cold names that waste time.

No. Leadica eliminates manual chasing. Our system answers every inbound call, text, and form instantly via AI Voice and SMS, then books the appointment directly into your CRM and calendar. This means no double-handling, no wasted follow-ups, and no administrative burden – just qualified meetings ready to convert.

AI Voice and SMS act like a digital assistant for your financial services business. When an enquiry comes in – whether by call, text, or form – our AI responds in real time, asks qualifying questions, and books the next step. Prospects are engaged instantly, even after hours, so you never lose opportunities to competitors.

Yes. You can use AI Voice and SMS as a standalone solution to manage inbound leads and revive your existing database. Many loan and insurance providers start this way. The biggest results, however, come when AI Voice and SMS are paired with outbound campaigns, creating both new and reactivated appointments.

Yes. Leadica integrates with most CRMs used in financial services – including Salesforce, Pipedrive, HubSpot, Adviser CRM, and Mortgage Brain. All data, notes, and bookings flow directly into your system, so you avoid messy imports or missed follow-ups. Your advisers work from the tools they already know.

Yes. Many clients begin with short-term or seasonal pushes – for example, mortgage peaks, insurance renewals, or personal loan promotions. Once you see results, you can scale the system month by month. You’re never locked into a long-term contract, so you can test and expand with confidence.

Competition is exactly why Leadica works. We cut through crowded markets with targeted campaigns and omnichannel follow-up, so your prospects see you first and often. Instead of chasing “everyone,” we focus on your best-fit clients and engage them across email, SMS, LinkedIn, voice drops, and retargeting until they book.

Leadica uses simple monthly pricing with clear deliverables – booked appointments you can measure. There are no hidden fees and no lock-in contracts. You can scale up or down based on your business needs.

After your free growth strategy session, we’ll map your ideal client profile, align your goals, and connect the system to your CRM. Campaigns are typically live within days – not weeks – so you can start seeing new consultations and policies within the same month.

For more detailed information on how Leadica can transform your lead generation and customer growth strategies, please contact us.

Our team is here to answer any further questions you may have.